The Keynes-Hayek Debate: Navigating Boom and Bust in the Economy!

I discuss the century-long debate between economists John Keynes and Friedrich Hayek on how to handle economic crises. Keynes advocated for government spending to stimulate the economy during recessions, while Hayek believed in letting markets self-correct through saving and investment....

The Uncertain Future of Cryptocurrencies

I discuss the uncertain future of cryptocurrencies, including the potential for a bubble, especially with Bitcoin, due to intense speculation. This could lead to a loss of trust and demand, as cryptocurrencies lack the legal backing and mandatory status within...

Blockchain's Promise and Pitfalls: Navigating the Crypto Landscape

I discuss how blockchain technology is revolutionizing various industries like healthcare, finance, and supply chains. However, we caution against the risks of speculative investments like Bitcoin and ICOs, which often rely on the greater fool theory without real economic value....

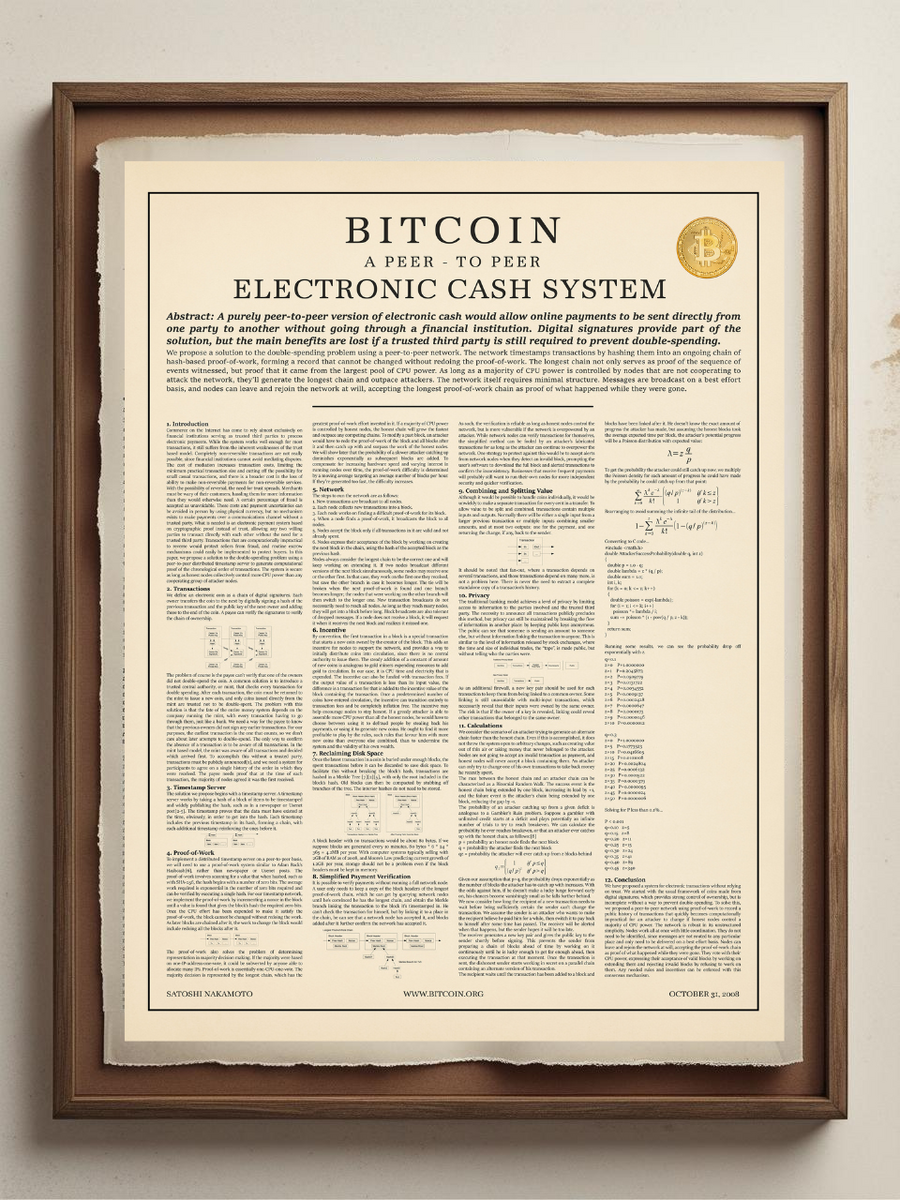

Bitcoin: A Peer-to-Peer Electronic Cash System

The Bitcoin whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto, was published in October 2008. It is nine pages long and outlines how Bitcoin works as a decentralized digital currency without relying on banks or trusted third...

The Rise of Bitcoin: Decentralized Digital Currency and the Blockchain

I discuss the rise of Bitcoin, a decentralized digital currency launched in Bitcoin enables electronic payments and global transfers without intermediaries or oversight, with transactions recorded on a public ledger called the blockchain. The system caps total Bitcoin at 21...

Understanding the Strength of the US Economy and Dollar

I discuss the principles behind the US printing of dollars, explaining that it is done to meet demand and exchange needs, not recklessly. We also highlight the key factors that make the US economy and the US dollar strong, including...