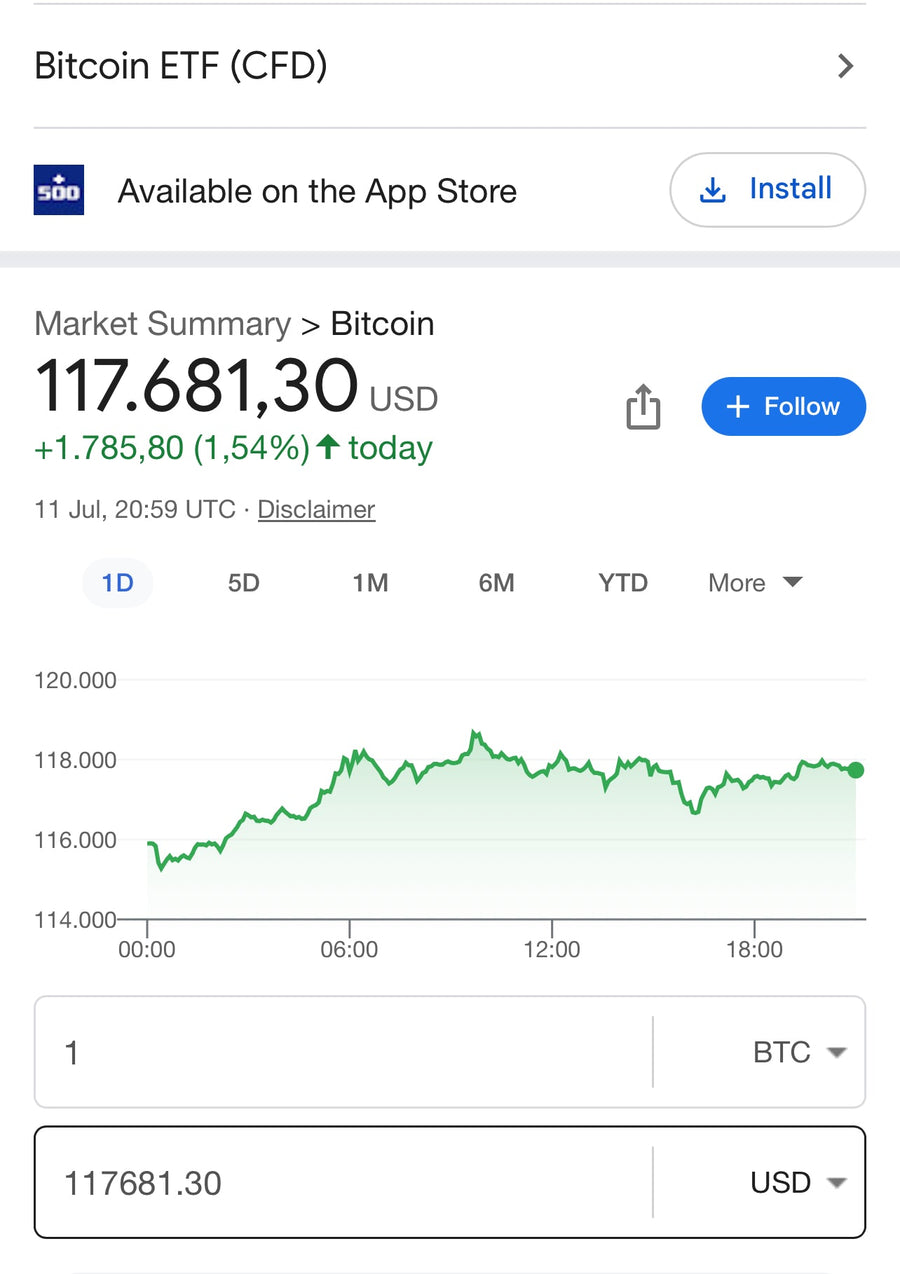

Bitcoin hits 118000 today

This is not just a number — it’s a message to the world that the era of decentralized money is here to stay. The key reasons behind this surge: Institutional investors are going all-in Limited supply: only 21 million Bitcoins...

the financial economist

Investment is not just the allocation of capital, but the quiet expression of trust in the future, where patience and risk converge to shape tomorrow's wealth.

In financial economics

Every investment is not merely a choice of risk and return, but a reflection of how individuals assign value to uncertainty, time, and the invisible forces that shape markets and behavior.

Capitalism: The Untold Game of the Wealthy

In this video, i explore how the wealthy view money and capitalism, the untold game. I discuss wealth inequality, the differences between an equal economy and an unequal economy, and how wealth concentration impacts the economy. I also talk about...

The Wealthy Mindset: Mastering Financial Concepts for Wealth Building!

How the Rich Think and Why You Should Change Your Relationship with Money. I discuss how the wealthy view money as a tool to expand their financial influence! The key is to transform from a consumer to an investor, understanding...

Don't Settle for Less: Reach for the Top.

the importance of not settling for less in life. We should surround ourselves with the best people and pursue the best job opportunities, rather than just tolerating what we have. The world is open to us, and we should keep...